Source: The Hindu (GDP slows down)

Context:

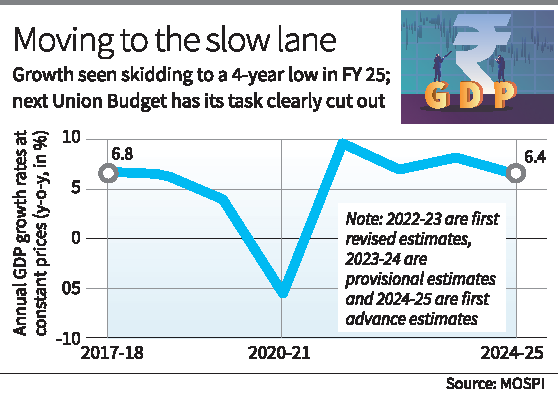

The National Statistics Office (NSO) released its first advance estimates of GDP for FY 2024-25, projecting a growth rate of 6.4%, the slowest in four years. This projection is critical for policymakers, particularly as the Union Budget for 2025-26 is being prepared.

UPSC Relevance:

Prelims:

- Important Terms:

- Gross Domestic Product (GDP)

- Gross Value Added (GVA)

- Gross Fixed Capital Formation (GFCF)

- Sectoral Trends: Agriculture, Manufacturing, Public Administration.

Mains (GS Paper III):

- Economic Development:

- Challenges in maintaining high GDP growth.

- Role of government expenditure and fiscal policies.

- Issues with Private Investment:

- Reasons for sluggish investment despite favourable conditions.

- Policy Implications:

- Need for targeted fiscal stimulus to revive growth engines.

Key Highlights of NSO’s GDP Projections:

GDP and GVA Growth:

- Real GDP Growth:

- Estimated at 6.4% in 2024-25, down from 8.2% in 2023-24.

- Economy rebounded in the second half of the fiscal year with an estimated growth of 6.8% after clocking 6% in the first half.

- Gross Value Added (GVA):

- Projected to grow at 6.4%, compared to 7.2% in 2023-24.

- Sectoral Growth:

- Agriculture: Growth expected at 3.8% (up from 1.4% last year).

- Public Administration, Defence & Other Services: Projected at 9.1% (from 7.8% last year).

- Manufacturing: Slows to 5.3%, a significant drop from 9.9% in 2023-24.

- Mining and Quarrying: Growth at 2.9%, down from 7.1%.

Concerns Over Investment Growth:

- Gross Fixed Capital Formation (GFCF):

- Indicator of fresh investments, projected to grow at just 6.4%, compared to 9% in 2023-24.

- Decline attributed to reduced government capital expenditure and sluggish private sector investment, despite favorable conditions.

- Construction Sector:

- Growth pegged at 8.6%, lower than 9.9% last year.

Expenditure-Side Analysis:

- Private Final Consumption Expenditure (PFCE):

- Expected to rise 7.3%, indicating improved household spending compared to 4% last year.

- Government Final Consumption Expenditure (GFCE):

- Projected to grow 4.1%, up from 2.5% in 2023-24.

Economic Implications of GDP slow down for Budget 2025-26:

- Key Challenge: Restoring GDP growth to 7%-plus levels achieved in preceding years.

- Impact of Monetary Policies:

- The RBI’s interest rate hikes and tighter lending norms have contributed to the slowdown.

- Lower fiscal stimulus has also played a role in tempering growth.

Expert Opinions:

- Dharmakirti Joshi (Crisil Chief Economist):

- Slower growth in 2024-25 attributed to high interest rates, reduced government spending, and sluggish private investment.

- A sharper focus on boosting private investments is critical.

- Madhavi Arora (Emkay Global Financial Services):

- The advance estimates are based on limited data available till November and are prone to revisions.